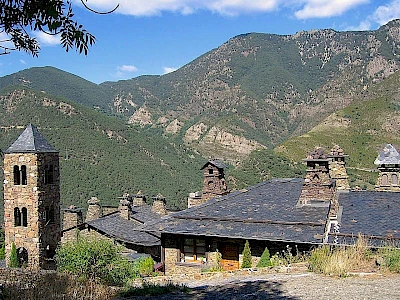

Featured services Andorra

Processing of residence permits in Andorra

In Andorra there are different types of residences:

Active

On their own

Residence and work

Passive

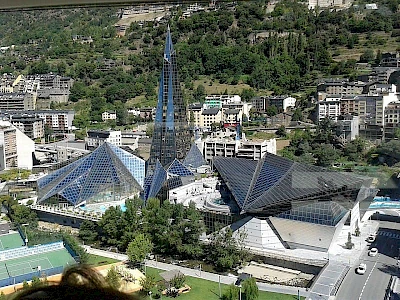

Incorporation of companies in Andorra

We offer all the services and procedures necessary to create your own company in Andorra, purchase and sale of shares or shares, as well as all the structural modification processes of the same.

Real Estate Advicing in Andorra

Real estate advice and management is a permanent service of legal advice and document management framed in the Andorran real estate sector.

Áreas de Práctica

The office is organised by areas of practice to guarantee that each issue is handled by specialised professionals.

Financial Area

The Torras Asociados Finance department offers businesses and the self-employed comprehensive account management through analytical accounting. We study formulas for tax savings, cost optimisation, ratio analysis, international taxation, comprehensive advice, etc.

We specialise in corporate tax planning, tax and exemption management (Corporation Tax, Value Added Tax...), enterprise valuation, corporate tax consolidation benefits, etc.

Contact us for personalised advice.

Make savings in your business!

Accounting for Companies and Business Owners

- Analytical accounting

- Cost accounting

- Invoice record book

- Balance sheets

- Profit and loss statements

- Annual accounts

- Annual report

- End-of-year accounting

Preparation and Analysis of Balance Sheets

- Company results

- Performance

- Tax saving

- Budget analysis

- Cost accounting

- Financing alternatives

- Arrangements with financial institutions

- Measures that increase the value of the business

Assessment and Management

- General Accounting Plan

- Financial statement consolidation

- Customer management accounting control

- High net worth individuals

- Family company

- Financial due diligence (acquisition and sale)

- Market due diligence

- Transactions and post-transaction services

- Legalisation of accounting books

Business and Personal Finances

- Fund management

- Credit solutions

- Financial cost optimisation

- Portfolio management

Company Taxes

- Corporation Tax

- IVA (VAT)

- International taxes

Tax Area

The Torras Asociados Tax department specialises in National and International Tax Planning, as well as National and International Investments, taking into consideration the peculiarities of accrued taxation, taxes and rates, the declaration of goods abroad, international double taxation agreements (DTAs) and other taxes for non-residents.

Our lawyers process tax residence, probate, inheritance and other international procedures, backed by Alliott Group offices in over 70 countries.

Contact us for personalised advice.

Optimise your revenue and assets!

Spain

- National and international tax planning

- Regional taxes

- National and international investments

- Transfer prices and related operations

- Assistance in processing binding consultations and advance pricing agreements

- Quarterly and annual tax obligations

- IVA (VAT)

- Corporate Tax

- Personal Income Tax for Residents and Non-residents

- Wealth Tax for Residents and Non-residents

- Property Transfer and Stamp Duty Tax

- Local taxes

- Taxes, rates and contributions

- Integrated individual and company tax planning

- Tax proceedings

- Tax inspections

- Inheritance and donations

- Inheritance and donations tax

- Due Diligence

Andorra

- International taxes

- Quarterly and annual tax obligations

- IGI

- Corporate Tax

- Personal Income Tax

- Taxes and rates

- Insurance sales tax (ISI

- Indirect Tax on Capital Transfers

- Betting Tax

- Communal Taxes

- Processing of residency applications

- On behalf of others

- On their own behalf

- Temporary

- Non-work

- Planning, incorporation and monitoring of companies

- Foreign investments

- Company restructuring operations

- Customs inspection

International

- Declaration of goods abroad

- Form of the Bank of Spain for assets and economic transactions abroad

- Forms of the General Directorate of Trade and Investment

- Tax regularisations

- International tax

- Obtaining of Foreign Identity Number (NIE) for non-established employees

- Obtaining and management of Enabled Email Address (DEH)

- International probate

- International inheritances

- Analysis and advice regarding International Double Taxation Agreements (CDI)

- Special tax regime for inbound assignees

- Non-Resident Personal Income Tax

- Non-Resident Wealth Tax

- Comprehensive management and supervision through the international offices of the Alliott Global Alliance

Employment Area

The Torras Asociados Employment department offerss businesses and the self-employed comprehensive management of their Social Security obligations and defence in Social Courts and Tribunals.

We process hiring and firing employees, recruitments, wage slips, payment orders, retirement, disability and unemployment. We advise on Social Security benefits and help you plan the workplace management of your business. We also offer assistance in various legal procedures, tax inspections, labour claims, collective disputes, etc.

Contact us for personalised advice.

Avoid labour disputes!

Social Security Benefits

- Comprehensive advice regarding social security benefits

- Calculations and planning

- Retirement, widowhood, permanent disability and unemployment

Payship

- Comprehensive advice and management of staff issues for businesses and freelancers in their various special social security systems (artists, senior management, domestic service)

- Hiring and firing of employees

- Contracts, modifications and agreements of any nature regarding the employment contract

- Management and preparation of wage slips and payment orders

- Preparation and processing of RNT (Employee Wage List) and RLC (Contribution Payment List) listing bulletins

- Preparation and processing of forms 111, 190 and 145

- Changes and incidents with the Social Security General Treasury

Auditing

TheTorras Asociados Auditors support you across all aspects related to Account Auditing, taking into consideration your obligations and limitations and providing specific financial and expert reports for each activity sector.

Contact us for personalised advice.

Make sure your accounts are right!